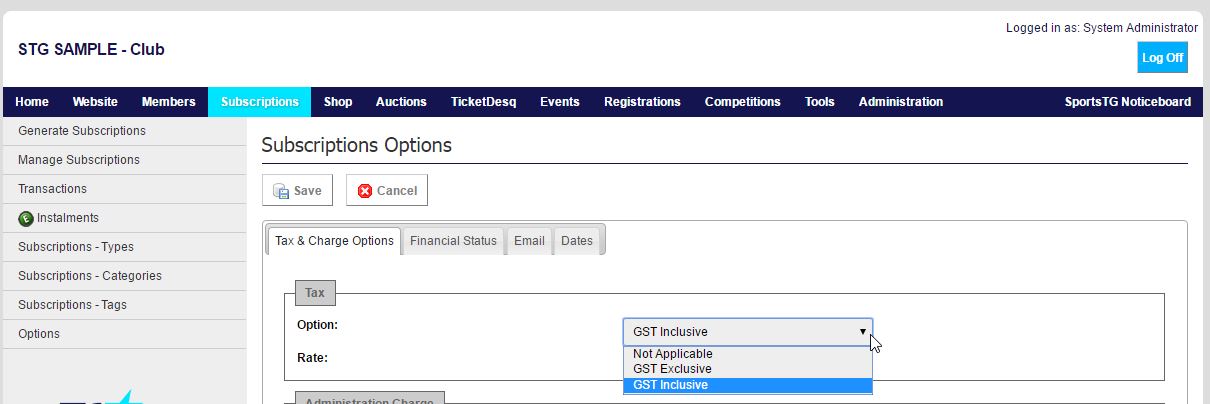

Quick Steps: Subscriptions > Options > Tax & Charge Options

Your Tax Rate (GST, VAT, etc) will be set up and determined based upon the country that your organisation is based in, but you then can determine whether this tax is applicable to your organisation within the Management Console.

1. Within the Management Console, select Subscriptions from the top menu, then Options from the left menu.

2. Click Edit at the top of the screen. 3. This will open in the Tax & Charges Options tab.4. You can then determine whether the tax is Not Applicable to your Organisation, or whether your prices are GST (or VAT) Inclusive or Exclusive. This will then be reflected in the receipts received by your members and what they are charged on the Members Portal.

- If GST is set to 'Applicable' it will display the relevant GST component of the money the club has received.

- If this setting is switched to 'Not Applicable,' the GST column will not display in the settlement report. The money received by the club or centre remains the same.

- If your organisation is registered for GST ensure that this setting is set to GST Inclusive to ensure that the GST amount is displayed on all of your members' receipts.